Florida Land Market Guide 2025: Insights, Trends & Opportunities

Florida has long been one of the most dynamic and diverse land markets in the U.S. — and 2025 is no exception. Whether you're holding undeveloped land as an investment, managing inherited property, or considering a sale, this guide will walk you through the trends shaping Florida’s land landscape and what they mean for your next move.

Why Florida’s Land Market Matters in 2025

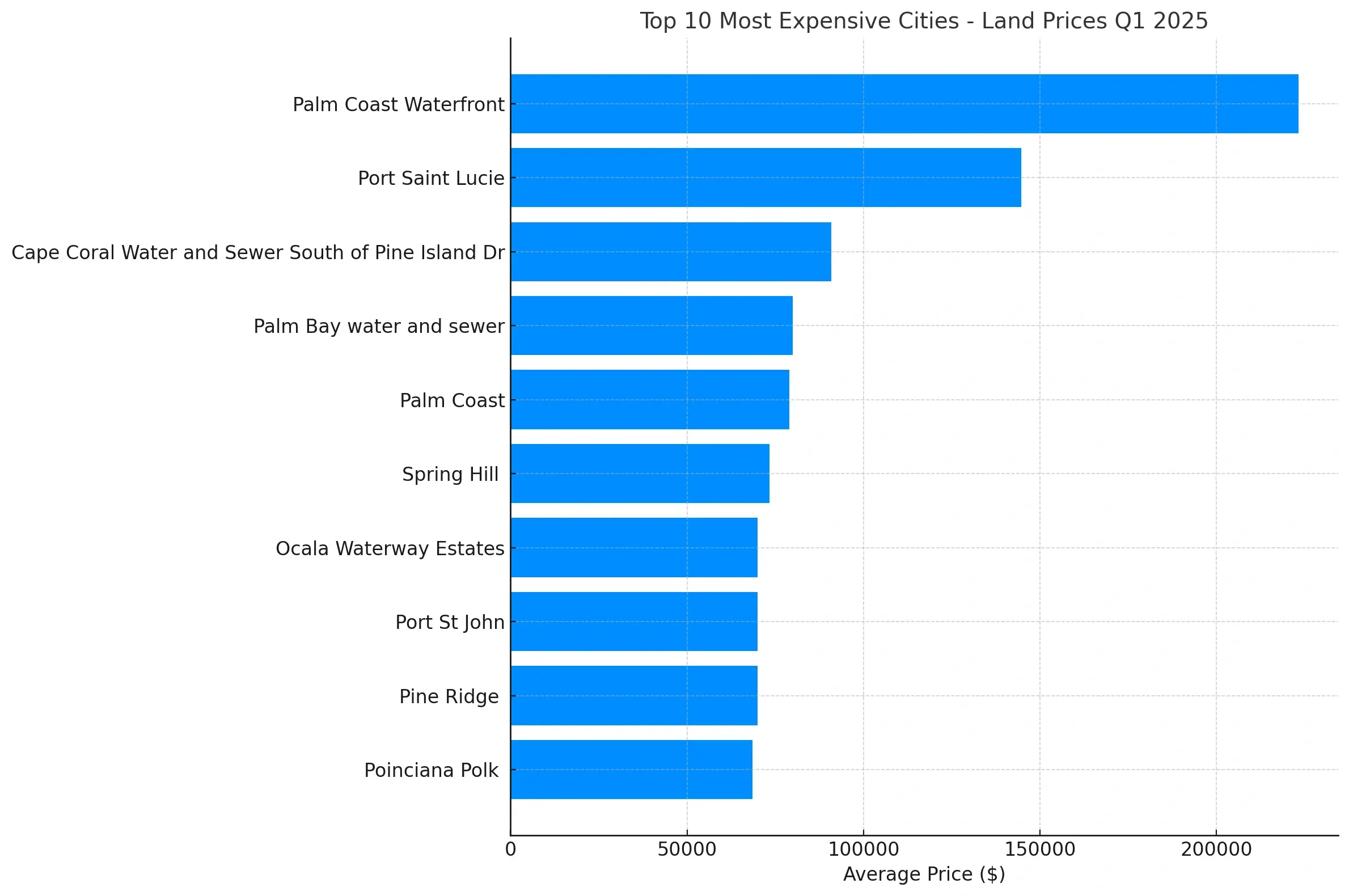

Florida's land market has shown impressive resilience and growth throughout 2024 and early 2025. Based on UNITY’s latest data, the average lot price across the state now sits around $48,379, with premium locations commanding significantly higher values.

Areas like Palm Coast Waterfront and Port Saint Lucie are leading the surge, with average lot prices exceeding $150,000, fueled by strong migration trends, limited inventory, and increasing development demand. Meanwhile, inland and emerging communities continue to offer affordable options, creating opportunities for investors and homebuilders looking for value-driven acquisitions in a dynamic and evolving market.

Factors Driving the Florida Land Market in 2025

1. Climate Change and Environmental Risks

Rising sea levels and severe hurricanes underscore the climate risks affecting Florida’s land market. Investors and developers are factoring in flood zones and insurance costs, favoring higher-ground properties and prioritizing resilient infrastructure to protect long-term value.

2. Population Growth and Migration Patterns

Florida’s population continues to surge due to strong in-migration from other states and abroad. A steady influx of retirees and remote workers from high-cost regions drives demand for land, supporting property values and fueling development across the state.

3. Shift in Demographics and Buyer Preferences:

Shifting demographics are changing buyer priorities in Florida. More young families and professionals are entering the market alongside retirees, creating demand for diverse housing options and community features. Many now prioritize walkable neighborhoods, sustainable design, and home-office space, shaping which land development projects move forward.

4. Technological Advancements in Real Estate

Advancements in real estate technology are streamlining transactions and expanding access to Florida land investments. Digital platforms, virtual tours, and data analytics allow investors to evaluate properties remotely with ease. These tools increase market transparency and efficiency, broadening the pool of potential buyers and speeding up land transactions.

5. Infrastructure and Development Investments:

Ongoing infrastructure upgrades and new development projects are unlocking growth in Florida’s land market. Projects like highway expansions, high-speed rail lines, and master-planned communities improve connectivity and make once-remote regions more accessible. Such investments boost local economies and raise demand for land in surrounding areas.

6. Economic and Interest Rate Trends:

Florida’s land market is sensitive to broader economic conditions and the interest rate environment. Strong job growth and corporate relocations into the state support land demand and higher property values. However, elevated interest rates are raising borrowing costs, which can temper buyer activity and slow the pace of new development.

Land Appreciation Hotspots in Florida for 2025: Top Cities and Best-Performing Areas

Florida’s most expensive land markets in early 2025 share several common traits: proximity to water, strong local economies, expanding infrastructure, and rising demand from both residents and investors. Cities like Palm Coast, Port Saint Lucie, and Cape Coral South benefit from limited supply, desirable locations, and growing buyer competition, pushing average land prices significantly higher. As migration trends continue and investment flows into these regions, these hotspots are setting the pace for Florida’s evolving land market.

Our 3-Step Process to Sell Your Land

1. Submit Your Details

First, the problems faced by businesses are identified. Raw structured as well as unstructured data is gathered.

2. Get your offer

First, the problems faced by businesses are identified. Raw structured as well as unstructured data is gathered.

3. Sign the Agreement

First, the problems faced by businesses are identified. Raw structured as well as unstructured data is gathered.

Why These Cities Are the Most Expensive in Q1 2025

| Rank | Area | Subdivision/Unit | Average Lot Price (May 2024 – Mar 2025) |

|---|---|---|---|

| 1 | Palm Coast Waterfront | C Section North (Units 14, 15) | $232,857 |

| 2 | Palm Coast Waterfront | C Section South (4, 6, 3, 2) | $224,286 |

| 3 | Palm Coast Waterfront | C Section (2 Bridges, Unit 16) | $194,286 |

| 4 | Port Saint Lucie | Torino PSL (Units 44, 46, 47) | $158,000 |

| 5 | Port Saint Lucie | NW PSL (Units 43 & 48) | $157,714 |

| 6 | Port Saint Lucie | Central PSL (Unit 39) | $157,143 |

| 7 | Port Saint Lucie | SW/SW North of Gatlin | $156,857 |

| 8 | Port Saint Lucie | SE PSL (Units 29, 30, 40) | $147,857 |

| 9 | Port Saint Lucie | PSL Central | $147,429 |

| 10 | Debary | Orlandia Heights (Acre Lots) | $124,286 |

-

Palm Coast Waterfront – $223,333

Reason: Waterfront properties in Palm Coast offer a rare blend of affordability (compared to South Florida) and luxury appeal. Strong demand from out-of-state buyers and limited waterfront inventory are pushing land prices up rapidly. -

Port Saint Lucie – $144,611

Reason: PSL has seen massive population growth, infrastructure investment (like Crosstown Parkway), and a growing reputation as a high-quality, lower-cost coastal alternative to Miami and West Palm Beach. -

Cape Coral (South of Pine Island Rd) – $90,833

Reason: This area includes many infill lots near water and utility-ready land. It has access to schools, commercial centers, and is fully serviced, driving up land desirability and values. -

Palm Bay (Water & Sewer Areas) – $80,000

Reason: Palm Bay has rapidly expanded, especially in well-serviced areas. The combination of utility access, tech-sector jobs, and highway proximity keeps demand high. -

Palm Coast (General) – $79,000

Reason: Master-planned community structure, growing commercial activity, and proximity to beaches have made Palm Coast one of the hottest relocation markets in Florida. -

Spring Hill – $73,333

Reason: Hernando County’s Spring Hill area attracts retirees and first-time homebuyers due to its affordability relative to Tampa Bay but with similar suburban appeal. -

Ocala Waterway Estates – $70,000

Reason: This upscale pocket in southwest Ocala is known for oversized lots, equestrian zoning, and newer construction, making it one of the most desirable in Marion County. -

Port St John – $70,000

Reason: Located near the Space Coast tech corridor, it attracts aerospace employees and investors. Utility infrastructure and proximity to Titusville and Cocoa help prices hold firm. -

Pine Ridge – $70,000

Reason: Known for large-acre estate homes and equestrian communities, Pine Ridge attracts high-income buyers looking for privacy and space near the Gulf. -

Poinciana Polk – $68,500

Reason: Though broader Poinciana is more affordable, the Polk side has newer infrastructure and proximity to Haines City and Davenport—areas booming due to their Orlando proximity.

GET HELP SELLING YOUR FLORIDA LAND

While At UNITY, we understand that selling land can be a complex and emotional decision. That's why we've designed a process that prioritizes your comfort and confidence:

Bottom 10 Land Value Cities (May 2024 - March 2025)

| Rank | Area | Subdivision/Unit | Average Lot Price (May 2024 – Mar 2025) |

|---|---|---|---|

| 1 | Poinciana (Osceola County) | Village 5 | $9,287 |

| 2 | Pt LaBelle & Banyan Village | Pricing Units 12–13 | $10,858 |

| 3 | Defuniak Springs | Unpaved | $11,429 |

| 4 | Rainbow Lake Estates | Rainbow Lakes Estates Expansion | $11,858 |

| 5 | Rainbow Park | General | $13,286 |

| 6 | Pt LaBelle & Banyan Village | Pricing Units 1, 2, 3, 6, 7, 8, 9 | $14,286 |

| 7 | Rotonda Lakes | General | $14,286 |

| 8 | Rolling Ranch Estates | General | $14,572 |

| 9 | Defuniak Springs | Paved | $14,858 |

| 10 | Rainbow Ends | Rainbows End Estates | $15,429 |

Areas like Poinciana (Osceola) and Pt LaBelle/Banyan Village have some of the most affordable land prices, likely influenced by oversupply or slower infrastructure growth.

Defuniak Springs appears twice, indicating consistent lower values compared to statewide trends.